Content

Normally while in the times of suspicion one silver growth interest or catches the attention of certain investors. Sooner or later, if the traders desire to purchase silver, they need to consider it as an element of their varied collection strategy. It is required to look at how it matches within the big image of their financial situation rather than because the a separate investment. When you are over the years low interest rates service gold by decreasing the options price of holding a non-yielding asset, industry traditional and the perceived stance of your own Provided usually enjoy a role basically-identity rates moves. Eric Sepanek ‘s the inventor of Scottsdale Bullion & Money, established in 2011. Having extensive knowledge of the fresh gold and silver coins community, he’s serious about educating Us citizens on the money maintenance energy from gold and silver.

What are interest levels? – goldenpokies

Gold reaches straight number highs six months in a row and flirted with our company$dos,200/ounce past Tuesday (8 March) in the intra-date change. U.S. monetary worries and you may trading stress don’t push the new rise earlier $3,one hundred thousand for each and every oz alone. Of a lot financing professionals end up being sure that the risks inside the geopolitics and you may the newest fiat currency program are merely marching higher. Gold-exchange replaced financing, which happen to be normally employed by west traders, went on to number web outflows in the first quarter of 2024, WGC research suggests — demonstrating your epicentre of one’s rally will be based upon the fresh Far Eastern. The fresh Provided fund rate is the right away rates at which Us banking institutions lend to one another. Simple fact is that oft-cited headline price put by Government Put aside during the their FOMC meetings.

Put To shop for Options

- The common duration and go back away from earlier silver rallies advise that the new recent rally might have far more prospect of growth.

- Which comes in a few suggests – basic, demand for gold as the a secure sanctuary investment from this latest macro uncertainty.

- Along side weekend, silver prices spiked to $38/ounce, symbolizing a virtually 30% year-to-go out go up.

- Talk about as to the reasons silver continues to be the greatest funding to have protecting riches up against rising prices, financial shifts, and you may global uncertainties.

- We do not provide monetary believed, chance analysis or modification of choices.

Although this get back is gloomier than simply certain earlier rallies, it actually was still good compared to the almost every other opportunities during those times. An average cycle and you may come back from previous gold rallies suggest that the brand new recent rally have far more potential for progress. The combination out of interacting with the newest the-date levels, geopolitical stress, support away from technology symptoms, and you can solid industry sentiment advise that the brand new gold rally is probably in order to persist. This type of issues create a powerful situation for those given investing silver. John Karow is actually a skilled lawyer and you may Precious metals Mentor at the Scottsdale Bullion & Coin. He keeps levels away from Lehigh College, the newest College from Missouri, Cornell University, and you will St. John’s College or university College or university away from Law.

Rising Governmental Stress

And since silver pushes its miners’ profits, the inventory costs of course go after gold large amplifying the gains. Silver features came up as among the most effective-carrying out possessions lately, and you may 2024 might have been a hallmark season for the rare metal. Surging more twenty five%, gold have damaged numerous details, motivated by the a variety of financial coverage shifts, robust central financial consult, and you can heightened geopolitical dangers. Even as we transfer to 2025, the chance stays confident, with many different fundamental things pointing to your an extension of one’s rally.

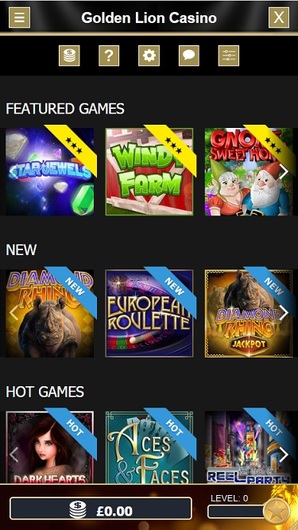

Reasonable giving the new slot a try is the estimated payout speed and this equals goldenpokies the new fulfilling 97,01%. If not otherwise clearly stated within the body of one’s article, in the course of writing, mcdougal doesn’t have condition in just about any inventory said within this blog post no business relationship having any business mentioned. The writer have not acquired settlement to have writing this article, aside from out of FXStreet.

Inventory Listing

A silver miners ETF would be a suitable choice for buyers trying to find connection with gold mining functions while keeping variation. John Reade, chief industry strategist at the WGC, claims this indicates that the grounds folks are to purchase silver “aren’t actually very much regarding the usa and west financial places”. Higher rates generally assist bolster a country’s currency because they make it a attractive location for global people to help you park their funds. Currently, the fresh ongoing rally reaches 131 months and has currently given an income of 96%.

Whenever interest levels shed, bond production (the fresh get back traders score to own carrying bonds) fall as well.dos Thus, when securities don’t render far when it comes to production, investors find possibilities. Really, gold is definitely a little while remarkable, responding to everyone’s economic twists and you will converts. It’s element of a much bigger tale that requires currencies, central banking companies, and you may a scene economy one to’s expanding increasingly unstable. Compared to the most other asset kinds including holds and you can securities, silver now offers restricted disadvantage chance. The built-in worth and you will historical resilience render a degree from protection against tall loss, also during the field downturns. Past its secure-sanctuary attention, gold try much more named a proper asset in the a good varied collection.

- So it interaction should not be relied up on since the only foundation inside a good investment and then make decision.

- This process to unlocking the value of stranded silver assets set a precedent based on how huge amounts of bucks out of illiquid, inactive silver assets around the world might be turned into water, tradeable wealth.

- Open the new timeless value of silver with the exclusive 2025 Silver Forecasting Statement.

- Gold’s prior seasonality just before 2024 try averaged inside try shown within the light-blue.

Investment in the ties comes to significant exposure and it has the potential for partial or over death of financing invested. It has to never be believed one to one information made might possibly be successful or equal the newest performance indexed within guide. That have an alternative many thanks so you can Craig and you will Carolyn Mullany-Jackson, goldRush Rally announced today the addition of Barrett Jackson since the a great mentor of our own then feel “An additional Work on From the Sunrays” within the 2022.

One comes after a just about all-date monthly filled with January and you can a yearly all of the-go out large at the conclusion of 2024. Orion’s Tom Wilson to your getting paired, high-touching provider inside a scene in which productivity alone no more set your apart. Goldman Sachs’ the newest private credit money aims to give options so you can 401(k) agreements, signing up for a wave of asset managers targeting the new DC business. “When we find other trend from inflation upcoming, then that ought to drive gold higher,” the guy informed Reuters. Best stories, better moving services, and you can change info brought to the inbox the weekday just before and you will following the field shuts. Once we is postponing all of our Silver Market Comments up until after the election, we desired to render an early on review during the silver’s magical run in 2024 – by numbers.